April 17, 2024 by Wahyu Septiyani

Saving money in banks offers numerous benefits, from improved security to attractive promotions.

From a young age, we are encouraged to save. This habit can potentially accumulate a significant amount of money over time. Our savings can become a means to realize our dreams and desires.

As adults, saving should be a part of our routine, yet some people still struggle to allocate funds for savings, often because their monthly income is insufficient.

Nevertheless, savings can be done anywhere, whether in banks, piggy banks, or safes. However, banks are often chosen as the most secure and profitable savings option, as they offer many benefits for registered customers.

Benefits of Saving in a Bank That You Can Enjoy

Before delving into the benefits of saving in a bank, let's explore some savings benefits obtained from various sources:

- Enhanced Security

Banks use sophisticated systems to safeguard customer deposits. These institutions will ensure protection against theft. Safe banks are licensed and supervised by the Financial Services Authority (OJK). Also, choose banks that are members of the Deposit Insurance Corporation (LPS), ensuring further guarantees on the money you save according to applicable LPS rules.

- Earning Interest

One of the most liked benefits of saving in a bank is the interest. The profit you get is not only from the accumulated money. You will receive additional from the interest.

Although it might not be very significant initially, consistent savings over time can result in greater interest growth. However, you need to pay attention to the varying interest rates between banks.

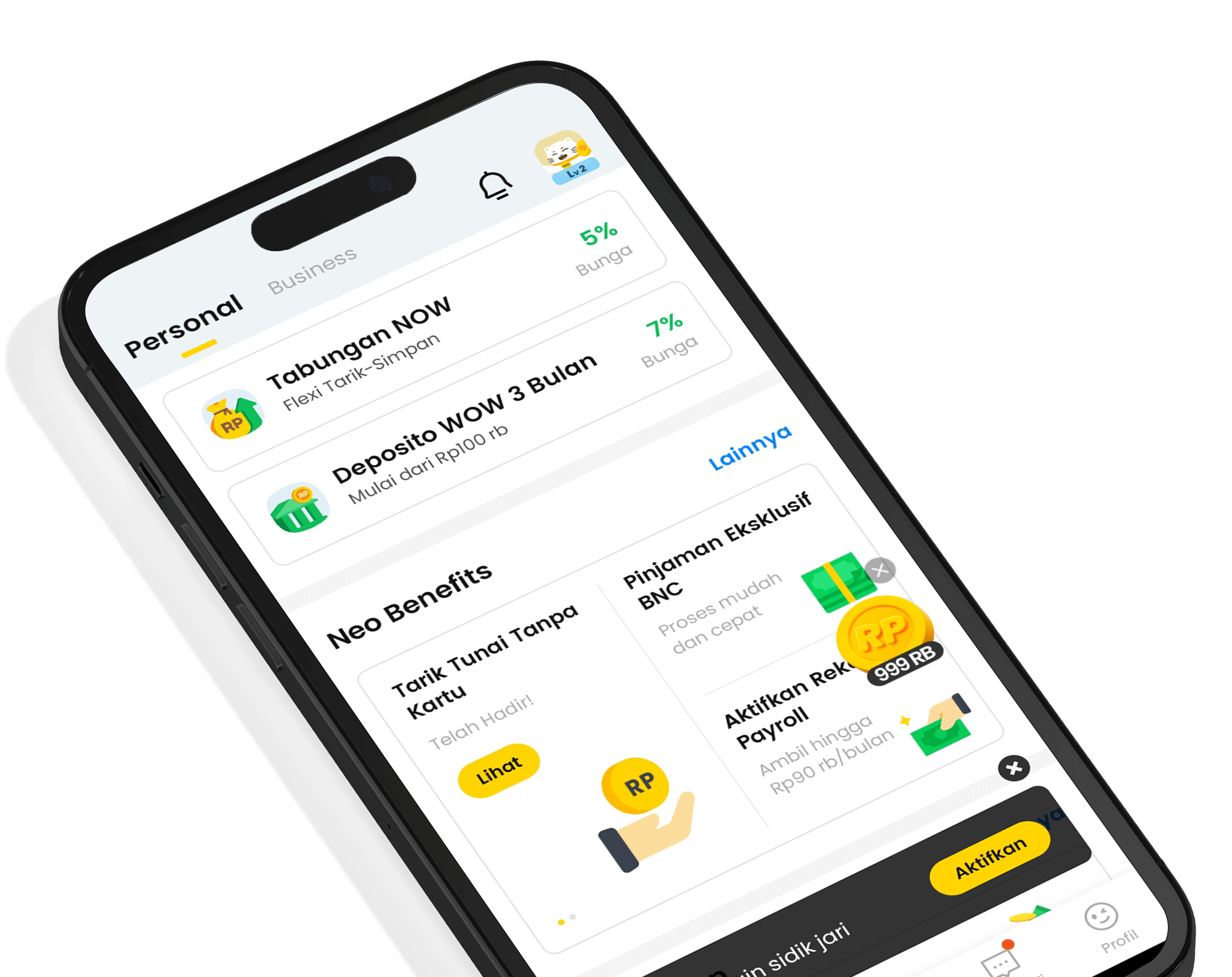

You can get more profit from interest by choosing products or banks that offer maximum interest like NOW Savings from Neo Commerce Bank.

Also read: What is an Emergency Fund? Here’s the Explanation, Benefits, and Calculation

- Convenience and Efficiency

In today's technological era, banks do not only provide conventional services. Banks also utilize online or digital features. Digital banking services facilitate unlimited transactions via mobile devices or computers.

This makes it easy for customers to conduct transactions. Activities such as transfers, withdrawals, and payments can be done easily and quickly.

You don't need to keep money at home which is prone to termite attacks and theft. Your money is securely kept by the bank. Come on, open a NOW Account for the security and convenience of storing money.

- Neater Financial Records

Banks have systems that record incoming and outgoing flows. If using a bank with digital services, you can check financial reports in real-time. Your money can be tracked well. You know where the money is spent.

From neat financial records, you can evaluate financial transactions transparently and easily.

- Attractive Promotions

Banks often collaborate with partners to offer attractive promotions, including shopping vouchers, discounts, reward points, or cashback incentives.

Neo Commerce Bank also has various attractive promotions. For example, if you transact using the neobank QRIS application at certain collaborating merchants, you will get a discount for each purchase of products or services by paying using QRIS neobank.

- More Economical

Saving cultivates the habit of economizing. You are encouraged to shop wisely. You will not be easily tempted to spend money if you are used to saving.

Instead of using money for something unnecessary, you choose to save money in savings. By restraining yourself from unnecessary expenditures, the savings remain intact, thus enhancing economic resilience.

Also read: How to Save Effectively, Consistently, and Profitably

- Realizing Goals Faster

Savings pave the way to achieve aspirations and realize big dreams such as home ownership, marriage, or travel abroad, religious travel, and others.

To realize big dreams, a substantial amount of money is needed. You need to accumulate money over a certain period and amount. These dreams cannot be achieved through piggy bank savings quickly.

- Minimizing Debt

With savings in the bank, you have enough funds for all needs, including sudden and emergency needs. You do not need to borrow money when you need it. There is savings in the bank that saves you. You are free from dependence on loans and promote a debt-free life.

- Increasing Discipline

Saving requires commitment and discipline, instilling responsible financial habits and ensuring consistent contributions toward future goals.

When you are used to doing it, saving is no longer a burden or responsibility. Saving has become a part of life. Likewise with economizing, thinking long before spending money, and how to treat money.

- A Secured Future

Rowing to the upstream and then swimming. What you sow today will yield in the future. Savings in the bank today will be useful for the future. You have provisions to live life, even though you are no longer productive and earning.

Saving in a bank provides security, efficiency, and benefits for financial growth and stability. Wise money management will help you achieve financial goals faster and more directed.

Come on, download the neobank app on PlayStore and App Store and open a NOW Savings now.

PT Bank Neo Commerce Tbk berizin & diawasi Otoritas Jasa Keuangan (OJK), serta merupakan bank peserta penjaminan Lembaga Penjamin Simpanan (LPS).