by Wahyu Septiyani

What is an Emergency Fund? Here’s the Explanation, Benefits, and Calculation

An emergency fund is a sum of money used for sudden needs. Here are the benefits and calculations for an ideal emergency fund.

Life often presents us with unexpected challenges, one example being the global pandemic. At the beginning of 2020, no one could predict the extent of the pandemic's impact on the world, and its effects continue to persist to this day.

The sudden loss of jobs experienced by many during this crisis underscores the importance of having a financial safety net to live safely and comfortably under all conditions.

Unfortunately, not everyone has savings to fall back on, hence the need for an emergency fund.

What is an Emergency Fund?

An emergency fund is a sum of money used for sudden needs. It serves as a financial buffer from unexpected situations, whether it be sudden unemployment, unexpected medical bills without insurance coverage, vehicle repairs, or natural disasters. Having an emergency fund can provide peace of mind during difficult times.

This fund also eliminates the desire to incur debt or to sell assets hastily, freeing you from emotional and financial pressure.

An emergency fund is not only for those with a stable income; even millennials with modest earnings can prepare a reserve for unforeseen situations. The amount of an emergency fund varies from person to person, depending on the individual’s financial situation.

Read also: Preparing for Retirement with the FIRE Method

Benefits of an Emergency Fund

There are numerous benefits to having an emergency fund, which can significantly increase financial stability and peace of mind:

Financial Security As a financial safety net, you have resources to face unexpected expenses or financial crises properly. You don't have to go into debt or use daily funds or savings allocated for other purposes.

Stress Reduction When you have a safety net for unexpected situations, you don't have to worry about where to get money. Thus, an emergency fund helps you reduce stress and anxiety. Having an emergency fund can also positively impact your well-being and mental health, making your life more comfortable and peaceful.

Avoiding Debt Debt is one of the financial burdens. You can avoid borrowing if you have enough funds for all kinds of needs, especially in emergencies. This way, you don't need to borrow from friends, payday loans, or banks.

Considerations for Opening a Savings Account to Prepare an Emergency Fund

In preparing an emergency fund, there are several things to consider, including:

Personal Status Whether single or married with dependents significantly affects the amount of funds needed. Responsibility towards family members dictates the need for a larger reserve.

Monthly Expenditure Percentage Typically, about 50% of monthly income is used to meet basic needs, and the rest is allocated for discretionary spending and bill payments. This amount depends on individual needs. Some may spend more, some less.

Preparing a Monthly Allocation for Emergency Savings A common practice recommended is setting aside about 10% of total income for an emergency fund. This percentage can be adjusted based on specific financial obligations.

Setting an Emergency Fund Target Calculating the ideal emergency fund starts with determining the desired amount. Singles are advised to target 3 to 6 times their monthly salary, while families should aim for 6 to 12 times their monthly expenses. For example, if someone earns 7 million rupiahs per month, the emergency fund target should range from 21 million to 42 million rupiahs.

Choosing the Right Emergency Fund Savings Instrument An emergency fund should be kept separate from regular accounts to prevent unintentional spending. This separation ensures that the emergency fund does not mix with other living expenses and accumulates quickly.

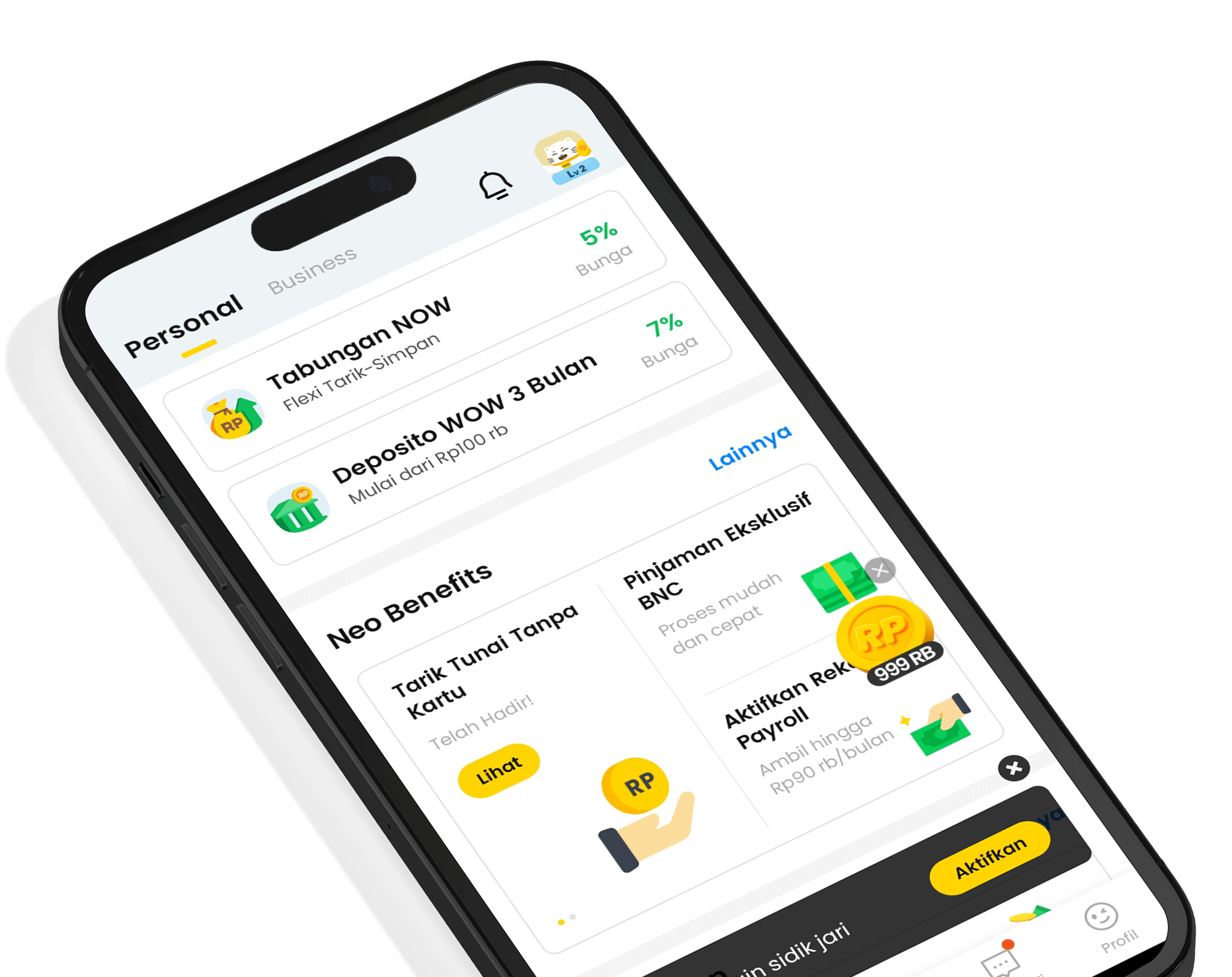

Consider opening a special savings account like NOW Savings. You can also keep your emergency fund in investment instruments like fixed deposits, for example, WOW Time Deposit.

Consistency Preparing this fund is a routine activity that requires discipline and consistency. Ensure you have a monthly budget specifically for the emergency fund and deposit a portion of your monthly income into the emergency fund account before it's used for other expenses.

Also, activating the automatic debit feature can facilitate consistent fund contributions. Moreover, do not use the emergency fund for other needs. Use it only for emergencies, not for snacks or hanging out.

Read also: The Difference Between Wealth Management and Financial Planning

Calculating the Emergency Fund According to Status

Actually, the exact amount of the emergency fund can be adjusted according to each individual's financial capability. However, according to financial experts, the ideal amount of an emergency fund is 6 to 12 times monthly expenses. This amount varies based on status.

Single or Unmarried For individuals who are unmarried, the amount of the emergency fund needed is 6 x monthly expenses.

Simulation Sisil's monthly expenses as a single person are IDR 5,000,000. How much emergency fund should Sisil prepare?

Ideal emergency fund amount for individuals with single status

IDR 5,000,000 x 6 months = 30,000,000

2. Married Without Children If you are married but do not have children, the amount of the emergency fund you need to prepare is 9 x monthly expenses.

Simulation

If Tono's expenses are IDR 7,000,000 per month, how much emergency fund should be prepared?

Expenses 7,000,000

Emergency fund amount for families without children 7,000,000 x 9 = 63,000,000

3. Married with Children For someone who is married and has children, the amount needed will obviously be more, namely 12 x monthly expenses.

Simulation

Bima's monthly expenses as a family head are IDR 13,000,000. How much emergency fund should Bima prepare?

Emergency fund amount for families with children IDR 13,000,000 x 12 = IDR 156,000,000

Preparing an adequate emergency fund is crucial for facing uncertainties in the future. By understanding its significance and determining the right size, millennials can proactively prepare for a more secure financial future. Start accumulating it today to protect yourself from unexpected challenges in the future.

The benefits are not just for today. If you already understand the importance and the ideal amount, let's download the neobank app from the PlayStore and App Store, and open a NOW Savings account to start preparing from now for a more peaceful future.

For complete information and terms & conditions regarding savings at neobank, visit https://bit.ly/neotabungandeposito

PT Bank Neo Commerce Tbk is licensed & supervised by the Financial Services Authority (OJK), and is a participating bank in the Deposit Insurance Corporation (LPS) guarantee program.