April 22, 2024 by Catra Ditya Ramawirawan

Undoubtedly, QRIS is one of the best innovations in the financial sector in recent years. However you pronounce it, has helped millions of people make transactions. The technology makes the transaction process easier for both buyers and sellers.

You may already know how to pay using QRIS. But do you know the definition, history, or purpose of its creation? If not, let's take a closer look at this practical payment feature.

Understanding QRIS

QRIS (Quick Response Code Indonesian Standard) is a payment standard using QR codes developed by Bank Indonesia along with the Indonesian Payment System Association. The main purpose of creating the QRIS application is to unify various types of non-cash payments that previously used different QR codes from each service provider. With QRIS, all types of payments can be made with one QR code throughout Indonesia.

History of QRIS

Launched in 2019, QRIS is a breakthrough in Indonesia's digital payment system. Previously, the digital payment market in Indonesia was very fragmented. Each bank and e-wallet service had its own QR code. This often caused confusion and inconvenience for users who had to install various apps to transact. With the creation of QRIS, Bank Indonesia aimed to create an integrated payment system, making it easier for consumers to use one QR code for transactions on all platforms.

This step is also part of Bank Indonesia's effort to enhance financial inclusion in Indonesia. Thanks to QRIS's cross-platform feature, more people, especially in remote areas, can access basic financial services. The presence of QRIS has supported the growth of Indonesia's digital economy by simplifying transactions for both consumers and business operators.

Benefits of QRIS

The existence of QRIS brings many benefits, both for business operators and consumers. Some of the main benefits of QRIS include:

- Universal: One QR code can be used for transactions across various banks and payment services. This means users do not need to have multiple apps for different payment needs.

- Easy Access: QRIS makes it easier for small and medium enterprises to accept electronic payments without having to have complex or expensive technical infrastructure.

- High Security: Transactions using QRIS are equipped with various layers of security that ensure the safety of funds and personal data of users.

- Cost Efficiency: With QRIS, transaction costs can be significantly reduced compared to other non-cash payment methods. This is very beneficial for business operators with large transaction volumes.

How QRIS Works

QRIS uses a QR code that can be scanned by the buyer through the payment app or e-wallet they have. When the QR code is scanned, the payment information is transferred from the buyer to the seller instantly. This process is not only fast but also secure, as all transactions are encrypted and processed in a protected network.

Static vs Dynamic QRIS

In the QRIS ecosystem developed by Bank Indonesia, there are two types of QR codes that can be used by business operators and consumers, namely Static QRIS and Dynamic QRIS. Both types of QRIS have different characteristics and uses.

Static QRIS

Static QRIS is a QR code whose value remains the same and does not change each time it is used for transactions. This code can be printed and placed in various locations such as cashier tables, store entrances, or on products being sold. The main advantage of Static QRIS is its ease of setup and use repeatedly without needing to create a new code for each transaction. This is very effective for small business operators who may not have a complex payment system.

However, Static QRIS also has limitations, especially in terms of security and flexibility. Because its value is fixed, Static QRIS does not include specific transaction information such as the payment amount required. Users must enter the payment amount manually, which can be prone to user input errors.

Dynamic QRIS

Unlike Static QRIS, Dynamic QRIS generates a new code for each transaction. This code integrates specific transaction details, including the amount of money to be paid. This reduces the risk of errors in entering payment amounts and enhances security because the code used is always changing and only valid for one transaction.

Dynamic QRIS is ideal for businesses that conduct many transactions in large amounts or that require high security levels, such as hotels, large restaurants, or e-commerce. The use of Dynamic QRIS simplifies financial record management because each code generated is automatically linked to accurate transaction details and specific transaction times.

Choosing Between Static and Dynamic QRIS

The choice between using Static or Dynamic QRIS largely depends on the type and scale of the business. For small businesses with relatively few and fixed daily transactions, such as a small coffee shop or street vendors, Static QRIS may be more practical and economical. Conversely, for larger businesses or those with more complex and varied transactions, Dynamic QRIS offers security and ease that better suit their business needs.

How to Pay Using QRIS from Neobank

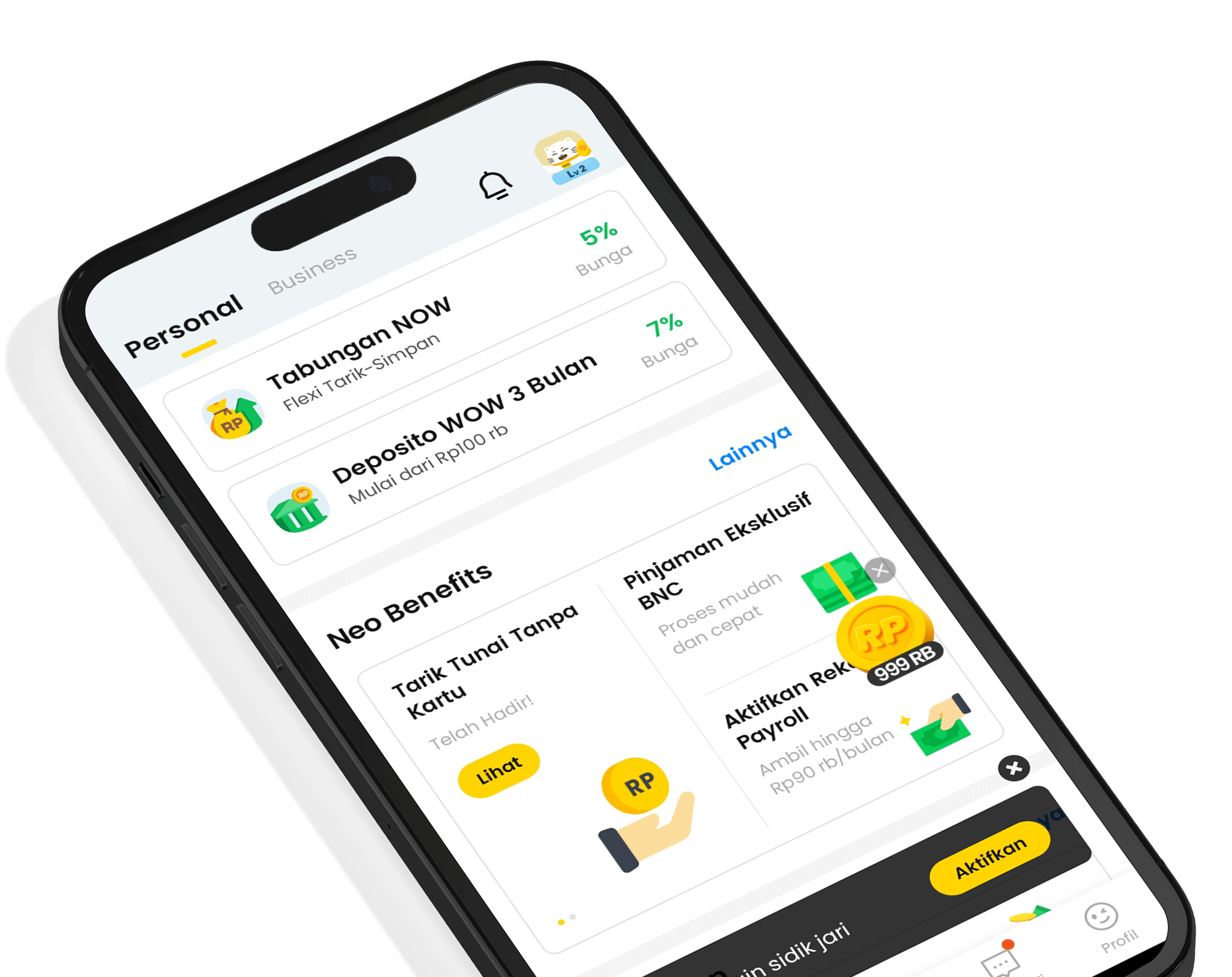

As one of the leading digital banking services in Indonesia, Bank Neo Commerce naturally also adopts QRIS technology. Not only practical, but transactions using the QRIS feature from neobank are also beneficial because there are many promotions and discounts from neobank that you can get if you transact using QRIS from neobank.

Here's an easy way to transact using the QRIS neobank from Bank Neo Commerce:

- Open the neobank App: First, open the neobank app on your smartphone. Make sure you have an active account at Bank Neo Commerce, and most importantly, make sure your balance is sufficient for the transaction. It would be embarrassing if the transaction failed due to insufficient funds.

- Select the QRIS Menu: Once opened, select the QRIS menu on the neobank home screen, precisely at the bottom-center of the home screen.

- Scan the QR Code: Point your phone's camera at the QR code displayed by the seller. Make sure the QR code is a QRIS that complies with Bank Indonesia standards.

- Confirm Payment: After the QR code is detected, the app will display payment details such as the merchant's name, payment amount, and others. Check and make sure all information is correct.

- Authorize the Transaction: Enter your PIN or biometric authentication to authorize the payment. This is a security step to ensure that the legitimate user is conducting the transaction.

- Transaction Completed: After authorization, your payment will be processed. Both you and the seller will receive payment confirmation instantly.

Benefits of Using QRIS from Neobank Using QRIS from Neobank has several specific advantages:

- Integration with Neobank Services: Transactions are not only easy and fast but also integrated with other services from Neobank, such as real-time transaction monitoring and financial management.

- Promotions and Discounts: There are often special promotions or discounts for users who make payments using QRIS from neobank.

Now that you know more about the QRIS payment system app, where do you want to snack using QRIS from neobank?